Redefine your financial journey with our keen investment advisory services.

We are an actively managed hedge fund with high margin of safety, data-driven investing and years of outstanding track record. Fund №2 including short investments, aiming for a "market neutral strategy" and record profitability on great short ideas.

Fund №1 never shorts, investing "Warren Buffett style". Or does it only with an unanimous vote from all the admitted partners. Focused on a long-investing approach, with progressive and higher diversification, if markets allow it.

Promoting and offering more and more quality businesses, at an attractive discount of their intrinsic value. We buy and hold these businesses.

In 2025 we upgraded our operation's strategies, integrating some of latest and most powerful AI models to our research routines, Python programs, and communication resources. Bringing unique insights, focus and in-depth analysis which clients would hardly find anywhere else, when reading other stock pickers' reports.

Our Family Office had also developed an unique routine to annalyze data, and compare parameters of hundred of interesting stocks, as hedge funds, from lists made on top of different strategies and well-know approaches to investing.

Running them through robust AI models, and quickly pointing out which ticker symbols follow valuable criterias, and we must focus on, the most. Doing it first, prioritizing correctly, and taking the time to accept or filter out, before it's too late to act, securing exposure before broader market recognition.

We operate an interesting strategy, and have multiple on the pipeline to be delegated to our team, many with AI/LLMs integration, as we also succesfuly outsourced the pursuit of high return strategies, due to early stage investments, on exclusive hedge funds. Some who are secretive and take little capital, nor new investors, to avoid saturating strategies, made to run on top of US small-caps and a max possible AUM of $250,000,000 - before saturation/reducing returns of their main strategy.

Join our main fund, or any of our low-entry cost partnerships, follow our easiest investment recommendations, or at a lower commitment, access our research publications, quarterly letters, published/recommended books, and investment insights.

Get in Touch

A modest $10,000 investment on Buffet's focus, delivered over $15,000,000 of value to clients - decades later.

"This 3-minutes video accurately represents our Growth Vision, our Family Office plans for value creation, for partners, family and clients, and the development of a new seven-people team, a new generation, of the brightest, most hard-working and prepared professionals we could gather.

Great examples and strong mentors inspire us to write down and chase the correct goals."

-Jacques D. Kahn

As an experienced investment advisor based in New York City, I am dedicated to providing personalized strategies that help you achieve your financial goals, as to discover and acquire new opportunities, achieving higher returns in your stock portfolios. With our same-day service and satisfaction guarantee, you can count on us.

Expert advice tailored to your unique financial situation

Transparent and ethical approach to investment management

High returns. Combined with high margin of safety and steady growth

Proven track record of delivering high and successful outcomes for clients

| Company | Stock / Sentiment | Buy/Report Date | Prev Day's Price | Avg. Entry Price | Current Price | Exit/Cover Price | Dividends Paid Out/ Entry to Q1'2026 |

|---|---|---|---|---|---|---|---|

| Fannie Mae (Federal National Mortgage Association) | FNMA / Bullish | Aug 07, 2023 | $0.45 | N/A | Check | $11.38 (Aug 12, 2025) | $0.00 (Growth stock) |

| Soleno Therapeutics, Inc. | SLNO / Bullish | 08/18/2025 | $71,63 | $68,71 | Check | Ongoing | $0 |

| UnitedHealth Group Incorporated | UNH / Bullish | 08/15/2025 | $306 | $306.92 | Check | Ongoing | $0 |

| Petrobras (Petróleo Brasileiro S.A.) | PBR / Bullish | 03/14/2023 | $10.54 | $9.83 | Check | $15.11 (97% sold) | $10.66 |

| X Financial | XYF / Bullish | 04-11-2024 | $3,72 | $3,82 | Check | $8,19 | $0.59 |

| LexinFintech Holdings Ltd. | LX / Bullish | 04-11-2024 | $1,72 | $1,81 | Check | $8,12 | $0.248 |

| Yiren Digital Ltd. | YRD / Bullish | Check | |||||

| DBV Technologies S.A. | DBVT / Bullish | 12-18-2025 | $23,03 | $21,54 | Check | Ongoing | $0(Growth) |

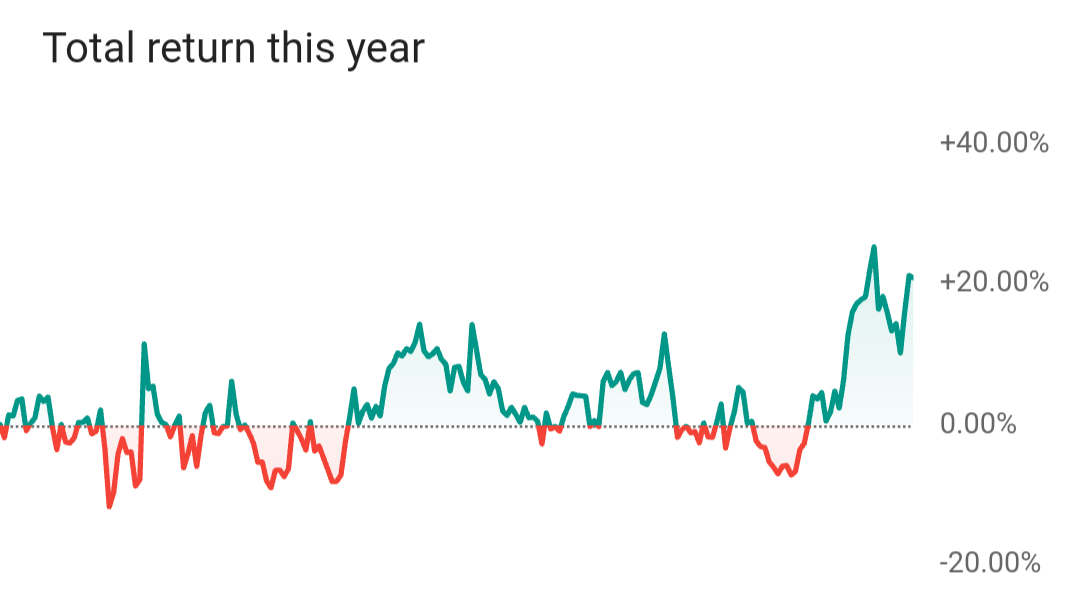

This October 2024 I'm glad to inform you that Fund N°1 heads toward another double digits, high return, year on year growth. As you see in the graph above.

The highest spike was caused by many of the investments we were recommending in China and across Asia, which almost doubled in price before the end of this 2024 season. Added to the double digit dividends we got paid along the last quarters from those specific stocks.

Our returns this year should had beaten our past years returns, because we got a higher growth on cash and common equity holdings, measured in millons of dollars accumulated, relative to each million dollars of valuation (market capitalization) bought out, from the publicly traded companies we selected.

However, due to many of this companies, being of smaller size than the ones picked the previous years, and despite many of these had consistent growth for multiple quarters, stock prices haven't corrected as quickly as happened last 2023-2024 season.

Hence we may need another year of wait time, before we hit double digit returns again, or even triple digit returns in our fund, thanks to all that cash flow, and growth on retained earnings, reported from the publicly traded stocks we selected."

-Jacques D. Kahn

(5:30 minutes)

We strive to add more value to our investment packages, and be a comprehensive fee-based financial services business, committed to helping families improve your decision-taking skills and long-term financial success. Also improving the situation and tax-efficiency of assets in, as also out of our partnerships and fund. With years of experience and successful track-record, Kahn Capital has been committed to delivering personalized programs and keen stock picks to help protect and grow our partners wealth.

Value Investing and Growth Generation.

(17-18 minutes).

My promise is to provide customized wealth management solutions that align with your financial goals and aspirations. With my...

Learn More

Don’t let taxes drain your resources. Let my expertise in tax mitigation help you maximize your savings and increase your future...

Learn More

I am an expert in information and researching, dedicated to providing you with accurate and comprehensive insights. Whether you need...

Learn More

Trust me to be your knowledgeable and trusted investment advisor. With my expertise in the industry, I will guide you towards financial...

Learn More

I offer tailored financial planning to help you achieve your long-term financial goals. With my extensive knowledge and personalized approach...

Learn More

Let me guide you towards financial success with my professional portfolio management services. With a deep understanding of the investment...

Learn MoreFund №2 is finally being launched! Contact us for more information and to join the first round of investments. We are still in the capital raising stage. Allocation will start as soon we have some quality short investing ideas.

We are ready to help you with your needs

Research, Equity Analysis &

Portfolio Management.

College student in Manhattan, NY, Jacques has a proven track record. Smart, honest, committed to research, transparency, good reputation & high results.

Sales and Customer Success - Advisor - Investor & Co-Founder

Retired Marketing professional, and successful salesmen-investor, living in Argentina. Offers advice to build customer acquisition strategies and effective communication.

Co-Founder and Marketing Specialist

Licensed insurance sales executive with years of experience in building client relationships and closing deals.

Co-Founder of our firm, leveraging his sales background to drive growth, enhance our brand and expand market presence.

Trust. Honesty. Integrity. Health. Respect for your unique talents and business growth. Dedication. Family. We believe values matter, and we live by ours every day. Developing transparency and more considerate client-advisor relationships.

My goal is to help you take a proactive approach to your personal financial situation. I am dedicated to helping you make sound decisions for your financial future. Helping you gain a better understanding of investing, retirement, estate planning, and wealth preservation. Most importantly, I hope you see the value of working with me to pursue your financial goals.

I offer tax mitigation, wealth management, added to information and research services. I can also assist with other needs around hedge fund investing.

I know many big names in the industry, and around the NYC area. So I could be also a valuable partner, simply connecting you to the right names and right asset managers. Specially on the short side.

If fees paid are too low, and due to other attitudes, families disqualify themselves from admission at other family offices and picky hedge funds, with unique approaches, which can help to diversify even more.

Our exceptional returns perhaps bring us closer to officially being considered a top tier hedge fund.

Often my "full capacity", before saturating our main strategy (Fund №1), it is significantly lower than Medallion's, but in 2023 our growth and base return, was higher than legendary funds, as the Medallion Fund's average yearly return, and we surpassed other "double digit return" hedge funds.

We did so with solid buy and hold strategies. Staying away from speculation.

Also if you seek higher diversification, I can coach you in comprehending the names, addresses, and operations of other solid but exclusive hedge funds.

I am located in New York City, serving clients in the city and surrounding areas. A Harlem neighbor living in 129st (moved out now), you can book personal appointments, in one of my desks, and main center of operations at:

2356 University Avenue 2nd Fl, New York City, NY, 10468

As an office, we also offer other valuable products at this address, useful to preserve health, stability and well-being of families, which you can consult about during the visit.

My business started with services provided in New York City since 2019, related with sales, consulting, and customer service roles. If you are curious about discovering new products, along our years of experience in those services, I still manage as a side gig an extensive catalog, of useful, innovative, and important products.

Out of simply recommending and providing access to great investments, "selling money", as the legendary sales executive Ben Feldman liked to say.

As a seasoned salesperson I always envisioned the win-win scenario of evolving, growing and finding the best, most practical, most profitable products for my clients, and help them buy, understand, and hold them.

These happened to be so good, that I buy most of the stock I recommended for my own portfolio, if I can. That's how all started and lot of my alpha came from eventually doing that.

I guarantee satisfaction with my services. All of my educational documents, free promotional stock reports, and other products, include a 365-day money-back guarantee, in case I don't bring you something new, to your projects, research methodology, or portfolio.

My services for you, is to research new ideas, and bring you higher returns with lower to none risks. Sometimes, I recommend or send material that's very popular or recommended, so it's normal that the client may already heard about that idea, investment strategy or financial product.

If that's the case, quick refunds are processed, and I do not charge you for services that didn't bring you something new and valuable. In simple words, you have a satisfaction guarantee, that you will receive high value, when you invest in our products, research services and competitive investment ideas.

Without fees, and without the multiplier of the leverage accepted by each client, our base results in year 2023-2024, were above 56% in capital gains, plus additional gains with dividend income.

Clients who feel comfortable leveraging our ideas, closed that year with triple digit year by year returns. Even after fees and paying single digit interest rates for leveraging.

Our fees are flexible and depends on the size of the client. But usually, we would feel comfortable working with a 2-24 structure, or similar, with a 2% base management fee, plus a 10%-24% performance fee, if my strategies and unique approach to the public markets continue providing above average returns.

This 10% fee, applies only on the range of returns above the first 30% annual return on capital (waterfall structure).

The first 8% of the annual capital gains and dividends, can be 100% guaranteed for the client/account upside and payout. Ensuring we consistently beat the S&P500, with an above average yield.

I am available to assist you on Fridays and Sundays from 08:45 AM to 04:30 PM. Now I'm also available Monday to Friday, from 4:15PM to 5PM (EST), after the NYC stock markets close. Premium clients have access to my main phone line 7 days a week, as is my duty to be in touch, and having clear communication, to provide a quality service.

Also, if you wish to subscribe to a premium package, we can keep you up to date, 5 days a week, about if any of the most interesting stocks, in our undervalued, or high-value, watchlists, reaches interesting discounts, which may make some clients want to invest with an additional deposit, adding a wider diversification to their portfolio with Kahn Capital.

Thanks to these additional stock investment ideas. With a high discount relative to their intrinsic value.

I provide my services on the same day. If I'm out due to holidays, or any other reason for delays, I usually answer or callback within one week.

Our returns are high, or even higher than many well-known Hedge Funds. And our strategies are similar sometimes.

However, the way we operate is through partnerships, with Limited Partners, and Kahn Capital working as the General Partner.

With this measure and legal structure, we reduce fees and maximize returns, avoiding to sacrifice long-term growth.

We try to avoid having the regulations involved with being a legally registered Hedge Fund, because those reduce our final return, increasing compliance costs, while bringing no significant benefit for clients.

This is a main "why we are a better choice" than some well-known Hedge Funds or other high-return Family Offices. Hedge Funds' operations and compliance costs are too high, and often they don't get enough good investment ideas to fully cover that fact.

We firmly believe that our investors' money can grow much more if we allocate any additional savings, on bold investment ideas. Chasing higher alpha. Than instead invest that portion on putting Kahn Capital in a position where we will require lawyers, advisors, additional employees and high compliance costs.

Nevertheless, other groups of investors may come out with good ideas, due to the numerous employees, compliance lawyers and "analysts" they hire, but such approach is too costly for investors and the margin of safety, is much lower than the higher rates we offer at Kahn Capital.

We work with them when we can, listening to their best ideas, if open to talk about them, but we are in business because Kahn Capital's ideas happen to be smarter and profitable.

Kahn Capital started as a Family Office in 2022. With time it grew at outstanding return rates, launched multiple products and expanded operations to assist, include and advice international investors out of our personal social networks. That's all in few words.

Didn't find the answer you are looking for? Contact US

I am a passionate IT/finance student, and sales executiveworking in New York City, dedicated to helping individuals, companies, small businesses, pension funds and big families, navigate the complex world of finance and stock investments. At Kahn Capital, as a family-owned business, I prioritize customer satisfaction, personalized service, and offer a same day service to ensure timely assistance. With a commitment to providing sound financial advice and strategies. Trust me to guide you towards useful books, study material, research platforms, financial advice consultations, and wise investment decisions that align with your goals and aspirations. Let's embark on a journey towards financial success together.

Recognized excellence in personalized investment advice and financial planning solutions.

Did you know that New York is home to one of the world's largest stock exchanges, the New York Stock

Exchange (NYSE)? This bustling financial hub attracts investors from all over the globe, making it an exciting

place for investment advisory services to thrive.